Looking for a co-branded credit card that offers top-tier rewards, exclusive brand perks, and minimal fees? Explore our handpicked list of the 10 best co-branded credit cards in India for 2025. Apply through GoPaisa and get up to ₹1500 in bonus rewards on top of your card benefits!

Co-branded credit cards are rapidly becoming the go-to choice for savvy shoppers in India, thanks to their exclusive brand benefits, accelerated reward points, and exceptional value on everyday spending. Whether you’re a frequent online shopper, a travel enthusiast, or a loyal customer of platforms like Samsung, Tata Neu, Amazon, Flipkart, Zomato, BookMyShow, or Vistara Airlines, there’s a co-branded card tailored for you.

In this blog, we’ve curated the 10 best co-branded credit cards in India for 2025, offering unmatched features, low fees, and ₹1500 guaranteed rewards when you apply via GoPaisa. Discover the ideal co-branded credit card to maximize your savings and enjoy premium perks from your favorite brands.

What is a Co-branded Credit Card?

Co-branded credit cards are specially designed credit cards issued in partnership between banks and popular brands, offering exclusive benefits when users shop with the associated brand’s products or services. These cards typically feature the logos of both the issuing bank and the partner brand, clearly reflecting their dual-benefit nature and brand collaboration.

Co-branded credit cards offer accelerated rewards and benefits tailored to loyal customers of partner brands, helping them save more on everyday transactions. Many leading banks issue these cards in collaboration with brands to provide exclusive rewards, cashback, or air miles across categories like dining, delivery apps, fuel, travel, and lifestyle. While the perks are brand-specific, these cards are widely accepted across major networks like Visa, RuPay, and Mastercard.

Top 10 Best Co-branded Credit Cards List

Check out the top 10 best co-branded credit cards available in India, carefully Picked by us to help you earn maximum rewards and brand-specific benefits.

1. Samsung Axis Bank Infinite Co-branded Credit Card

- Best For: Travel and shopping

- Reward Type: Reward Points and cashback

- Welcome Benefits: 30,000 EDGE Reward Points

- Joining Fee: ₹5,000 + GST

- Renewal Fee : ₹5,000 + GST

Key Benefits:

- Upto 10% cashback across Samsung products and services (upto ₹20000 annually)

- Upto 3% value back on selected partners (Myntra, Zomato, BigBasket, Tata 1Mg, Urban Company)

- Complimentary Eazydiner membership for a year

- 3% value back on international transactions

- 1% fuel surcharge waiver

- Complimentary Lounge Access (8 domestic and 6 international airport lounge access annually)

- 5 EDGE Reward points on domestic transactions and 15 EDGE Reward points on international transactions for every ₹100 spent

The Samsung Axis Bank Infinite Credit Card is a premium co-branded credit card launched by Axis Bank in partnership with Samsung, a global leader in electronics and technology. Designed exclusively for Samsung customers, this card offers a host of premium benefits when buying Samsung products online or offline.

As a welcome gift, cardholders receive 30,000 EDGE Reward Points upon completing three transactions within the first 30 days of activation. Enjoy 10% cashback on Samsung purchases and earn 15 EDGE Reward Points per ₹100 spent. Additionally, the card unlocks exceptional travel privileges, including complimentary access to both domestic and international airport lounges.

Also read, 7 Best Shopping Credit Cards in India – Apply & Earn ₹2300 GoPaisa Rewards!

What’s the best part? Apply for Samsung Axis Infinite co-branded credit card today via GoPaisa and get an additional ₹1500 GP Rewards upon card approval and dispatch!

Apply Samsung Axis Bank Infinite Credit Card Now

2. IndianOil RBL Bank XTRA Co-branded Credit Card

- Best For: Fuel

- Reward Type: Reward Points

- Welcome Benefits: 3,000 Fuel Points

- Joining Fee: ₹1,500 + GST

- Renewal Fee: ₹1,500 + GST

Key Benefits:

- Get 3,000 fuel points on the first transaction of ₹500 or more within 30 days of card issuance.

- Earn extra 1,000 fuel points on spending ₹75,000 in a quarter

- Earn 15 fuel points for every ₹100 spent at IndianOil fuel stations (capped at 2000 fuel points/month).

- Earn 2 fuel points for every ₹100 spent on all other transactions

- Get 1% fuel surcharge waiver (up to ₹200 per month)

The IndianOil XTRA Credit Card is one of RBL Bank’s exclusive co-branded fuel credit cards, launched in partnership with IndianOil to offer exceptional savings on fuel spends. With this collaboration, RBL Bank joins the ranks of HDFC Bank, Axis Bank, and Kotak Mahindra Bank as the fourth issuer to offer co-branded fuel credit cards with Indian Oil Corporation Limited (IOCL).

Cardholders can save up to 8.5% on IndianOil fuel transactions, which is equivalent to nearly 250 liters of free fuel per year. Thanks to this industry-leading reward rate, the IndianOil RBL Bank XTRA Credit Card outperforms competitors like the BPCL SBI Card Octane, which offers up to 7.25% value back on fuel.

Apply for the IndianOil XTRA Credit Card today via GoPaisa and earn an additional ₹850 in GoPaisa Rewards. This GoPaisa reward is on top of your regular card benefits!

Apply for IndianOil RBL Bank XTRA Credit Card

3. HDFC Pixel Play Co-branded Credit Card

- Best For: Shopping

- Reward Type: Cashback

- Welcome Benefits: Nil

- Joining Fee: ₹500 + GST (Waived on spending ₹20,000 or more within 90 days of card activation)

- Renewal Fee: ₹500 + GST (Annual fee waiver on spending ₹1 lakh or more in a year)

Key Benefits:

- 5% cashback across categories and merchants (capped at 500 points/month)

- Dining & Entertainment – BookMyShow & Zomato

- Travel – MakeMyTrip & Uber

- Grocery – Blinkit & Reliance Smart Bazaar

- Electronics – Croma & Reliance Digital

- Fashion – Nykaa & Myntra

- 5% reward points on Smartbuy (capped at 500 points/month)

- 3% cashback at e-commerce merchants like Amazon, Flipkart and PayZapp

- 1% cashback on UPI Spends and all other spends

HDFC Bank has launched the Pixel Play Credit Card, a dynamic and affordable option designed for young professionals and avid shoppers. With a joining fee of just ₹500, this card unlocks a world of rewards that turn everyday spending into real savings.

Earn 5% cashback on leading brands like Zomato, BookMyShow, Uber, MakeMyTrip, Blinkit, and more across categories such as dining, travel, groceries, electronics, and fashion. You’ll also earn 1% cashback on all other spends. Plus, enjoy hassle-free redemption through HDFC’s CashPoints system.

Also check, Top 5 Best Cashback Credit Cards in India 2025!

Simply apply for the HDFC Pixel Play Credit Card via GoPaisa and earn an additional ₹1500 in GoPaisa Rewards upon card approval and dispatch!

Apply for HDFC Pixel Play Credit Card

4. Federal Bank Scapia Co-branded Credit Card

- Best For: Travel and shopping

- Reward Type: Reward Points

- Joining Fee: Nil

- Renewal Fee: Nil

Key Benefits:

- 10% reward points on every eligible online or offline purchases (1 reward point = 1 Scapia coin)

- Zero forex markup on all international transactions (no foreign currency exchange fee)

- 1% Fuel surcharge waiver (capping of upto ₹500/month)

- Unlimited domestic airport lounge access (a minimum transaction of ₹10,000 per month on Visa or ₹15,000 per month on RuPay card is required)

Federal Bank, in collaboration with fintech partner Scapia, has launched the lifetime free co-branded Federal Bank Scapia Credit Card. Earn 20% Scapia Coins on every hotel and flight booking made through the Scapia app using this card. Plus, enjoy unlimited domestic lounge access every month by spending ₹10,000 on the Visa variant or ₹15,000 on the RuPay variant.

All eligible online and offline transactions earn 10% Scapia Coins, making this one of the most rewarding travel credit cards in India. What sets it apart is its unlimited point redemption, no restrictive caps or expiry. Instantly redeem your Scapia Coins for flight and hotel bookings directly in the app, with faster, hassle-free redemptions compared to traditional credit cards.

Apply for the Federal Bank Scapia Credit Card via GoPaisa and earn an additional ₹650 in GoPaisa Rewards!

Apply for Federal Bank Scapia Credit Card

5. IndianOil Axis Bank Co-branded Credit Card

- Best For: Fuel & Shopping

- Reward Type: Reward Points

- Welcome Benefits: 1,250 EDGE Reward Points (worth ₹250)

- Joining Fee: ₹500 + GST

- Renewal Fee: ₹500 + GST

Key Benefits:

- 4% value back on fuel spending on IOCL fuel stations (20 reward points per ₹100 spent)

- Up to 15% discount on dining with Axis Bank partner restaurants under Dining Delights program

- 10% instant discount on movie ticket bookings via BookMyShow app or website

- 1% fuel surcharge waiver

- 1% cashback on online transactions (5 rewards point per ₹100 spent)

The IndianOil Axis Bank Credit Card is a co-branded fuel credit card launched in partnership with Indian Oil Corporation Limited (IOCL). Designed for frequent commuters and regular fuel spenders, this entry-level card comes with a nominal joining and annual fee of ₹500.

With this Axis co-branded credit card, you earn 4% value back on fuel spends at IOCL fuel stations and 1% rewards on online purchases. It also offers lifestyle benefits like instant discounts on dining and movie ticket bookings.

Apply for the IndianOil Axis Bank Credit Card via GoPaisa and earn ₹1500 in GoPaisa Rewards!

Apply For IndianOil Axis Bank Credit Card

6. Samsung Axis Bank Signature Co-branded Credit Card

- Best For: Shopping

- Reward Type: Reward Points & Cashback

- Welcome Benefits: 2,500 Axis EDGE reward points on completing at least 3 transactions within the first 30 days of card approval.

- Joining Fee: ₹500 + GST

- Renewal Fee: ₹500 + GST

Key Benefits:

- Earn 10 Axis EDGE reward points on every ₹100 transaction with selected brand partners such as Myntra, Tata 1mg, Bigbasket, UrbanCompany etc.

- Get 5 EDGE reward points on every ₹100 spent on domestic and international purchases.

- Receive 10% cashback on Samsung products and services purchases.

- Avail 1% fuel surcharge waiver across all fuel stations(fuel transaction from ₹400 to ₹4000)

- Avail 15% discount on dining with a minimum spending of ₹1500 on restaurants across the country (max discount up to ₹500).

- Enjoy 4 complimentary lounge accesses every year at domestic airports.

Axis Bank has partnered with leading electronics giant Samsung to launch the Samsung Axis Bank Signature Co-branded Credit Card. While it is an entry-level offering, this card delivers an impressive 10% cashback on all purchases of Samsung products and services made through the Samsung website or mobile app.

As a welcome benefit, cardholders receive 2,500 Axis EDGE Reward Points upon completing three transactions within 30 days of card activation. The card also offers 15% discount on dining at partner restaurants, 10 EDGE Reward Points per ₹100 spent at popular merchants like Myntra, Tata 1mg, Bigbasket, and UrbanCompany, and an additional 5 EDGE Points per ₹100 spent on all other domestic and international purchases. To top it off, users enjoy a 1% fuel surcharge waiver at all fuel stations across India.

Apply for the Samsung Axis Bank Signature Co-branded Credit Card via GoPaisa and earn ₹1500 in GoPaisa Rewards!

Apply for Samsung Axis Bank Signature Credit Card

7. IRCTC HDFC Bank Co-branded Credit Card

- Best For: Travel

- Reward Type: Reward Points

- Welcome Benefits: ₹500 Amazon gift voucher (available within the first 30 days of card activation)

- Joining Fee: ₹500 + GST

- Renewal Fee: ₹500 + GST

Key Benefits:

- Earn 5 reward points for every Rs. 100 spent on train ticket bookings through IRCTC’s website and Rail Connect App

- Get 1 reward point for every Rs. 100 spent on all other transactions

- Avail an additional 5% cashback on train ticket booking via SmartBuy

- 8 complimentary rail lounge accesses to IRCTC Executive Lounges every year (2 per quarter)

- 1% transaction charges waiver on travel bookings done on IRCTC ticketing portal and Rail Connect app

The IRCTC HDFC Bank Credit Card is a co-branded travel credit card tailored for frequent train travelers. It’s an excellent choice for individuals who regularly book train tickets via the IRCTC website or app, offering exclusive rewards to enhance every journey.

Cardholders earn 5% value back as reward points on IRCTC ticket bookings made directly through the IRCTC website or app. Plus, there is an additional 5% cashback when booked via HDFC Bank’s SmartBuy portal. Beyond rewards, users also enjoy 8 complimentary railway lounge accesses annually, making it a great fit for regular rail commuters.

Apply for the IRCTC HDFC Bank Credit Card via GoPaisa and get ₹1,200 in extra GP Rewards on card approval and dispatch!

Apply for IRCTC HDFC Bank Credit Card

8. HDFC Tata Neu Infinity Co-branded Credit Card

- Best Suited For: Travel and Shopping

- Reward Type: NeuCoins

- Welcome Benefits: 1499 NeuCoins (credited after first transaction within 30 days of card activation)

- Joining Fee: ₹1,499 + GST

- Renewal Fee: ₹1,499 + GST

Key Benefits:

- 5% NeuCoins rewards points on non-EMI transactions on Tata Neu and Tata partner brands such as Air India, Westside, Zoya, FastTrack, Tanishq, etc

- Additional 5% NeuCoins on Tata Neu app and web purchases after signing up for Tata NeuPass

- 5% NeuCoins rewards on every utility bill payment using Tata Neu app

- 1.5% NeuCoins cashback on Non-Tata brand purchases and any merchant EMI spends

- 1.5% NeuCoins rewards (up to 500 NeuCoins per month) on UPI spends via RuPay card variant

- 8 complimentary domestic lounge visits every year (Maximum 2 per quarter, on transaction of Rs. 50,000 in the previous quarter)

- 4 complimentary international lounge access every year (Maximum 1 per quarter)

- 1% fuel surcharge waiver (up to Rs. 500 per month)

HDFC Bank has partnered with Tata Neu to launch the Tata Neu Infinity HDFC Bank Credit Card, an exceptional co-branded credit card designed to elevate your shopping experience across the Tata ecosystem. This premium card offers exclusive privileges across multiple spending categories and is ideal for users loyal to Tata brands like Croma, Air India, BigBasket, Tata CLiQ, and more.

With an annual fee of ₹1,499, the card justifies its cost by offering welcome benefits of equivalent value. Cardholders can earn up to 10% cashback on Tata brand purchases, making it one of the best shopping credit cards in India. Additional perks include complimentary domestic and international lounge access, air accident insurance, and zero liability protection on lost cards.

Also check, Tata Neu Referral Code Offer Here!

Apply for the HDFC Tata Neu Infinity Credit Card via GoPaisa to earn an extra ₹1,200 in GP Rewards upon card approval and dispatch.

Apply for HDFC Tata Neu Infinity Credit Card

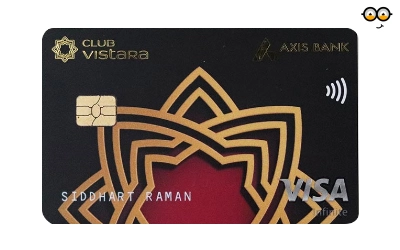

9. Axis Bank Vistara Infinite Co-branded Credit Card

- Best For: Travel

- Reward Type: Reward points and cashback

- Welcome Benefits: Complimentary Business Class Ticket + Club Vistara Gold Membership

- Joining Fee: ₹10,000 + GST

- Renewal Fee: ₹10,000 + GST

Key Benefits:

- Earn 6 CV Points for every Rs. 200 spent, accelerating rewards for flight upgrades and award tickets with Vistara

- Earn extra Maharaja Club Points and up to 4 Business Class flight ticket vouchers after reaching a specific spending milestone.

- 40% discount at partner restaurants under the EazyDiner program (capped at ₹1000 per transaction)

- 8 complimentary domestic lounge accesses (2 per quarter)

- Club Vistara Gold Membership with exclusive travel benefits.

The Axis Bank Vistara Infinite Credit Card is one of India’s most premium co-branded airline credit cards, offering exclusive access to Vistara Business Class privileges. Ideal for frequent flyers, this card includes a complimentary Business Class ticket as a welcome benefit, along with ₹1,000 GP Rewards when you apply via GoPaisa.

Cardholders enjoy complimentary Club Vistara membership and earn 6 CV Points for every ₹200 spent, which can be redeemed for flight tickets and upgrades. On meeting annual spending milestones, you can unlock up to four free Business Class tickets per year.

Additional travel and lifestyle benefits include two complimentary domestic airport lounge accesses every quarter and six free golf rounds at select courses across India. Apply now via GoPaisa and earn ₹1,500 in extra GP Rewards on approval and dispatch.

Apply for Axis Bank Vistara Infinite Credit Card

10. HDFC Bank Indian Oil Co-branded Credit Card

- Best For: Fuel

- Reward Type: Reward Points

- Welcome Benefits: Nil

- Joining Fee: ₹500 + GST

- Renewal Fee: ₹500 + GST (waived on annual spends of ₹50,000 or more)

Key Benefits:

- Up to 50 liters of free fuel per year

- 5% fuel points at IndianOil outlets (capped at 250 fuel points/month for the first 6 months, afterwards decreases to 150 fuel points/month)

- 5% fuel points on groceries, utility bill payments, and other e-commerce transactions (capped at 100 fuel points/month for each category)

- 1 fuel point for every ₹150 spent on all other purchases (including UPI transactions)

- 1% fuel surcharge waiver at all fuel stations on a minimum transaction of ₹400 (capped at ₹250/month)

- Complimentary membership of IndianOil XTRAREWARDS (IXRP)

The IndianOil HDFC Bank Credit Card is a co-branded fuel credit card launched in partnership with IndianOil Corporation. This card rewards users with fuel points redeemable at IndianOil fuel stations, making it ideal for frequent commuters.

Cardholders earn 5% cashback as fuel points on fuel spends and an additional 5% rewards on groceries and utility bill payments, turning routine expenses into valuable savings.

Apply for the HDFC IndianOil Credit Card via GoPaisa and get ₹1,200 in extra GP Rewards on card approval and dispatch.

Apply for HDFC Bank IndianOil Credit Card

Documents Required for Co-Branded Credit Card Application

To apply for a co-branded credit card, here are the mandatory documents you need to submit to get a credit card –

Identity Proof

- Aadhaar Card

- PAN Card

- Passport

- Voter ID

Address Proof

- Utility Bills (electricity, water, gas)

- Bank Account Statement

- Rental Agreement (if applicable)

Income Proof

- Latest 3 months’ salary slips

- Income Tax Returns (ITR) for last 2 years

- Form 16 (for salaried individuals)

- Bank statements (for self-employed)

Passport-size Photographs

Note: Additional documents may be requested depending on the co-branded credit card you have applied for.

Conclusion

Co-branded credit cards are the perfect fit for shoppers who stay loyal to their favorite brands and want to enhance their lifestyle with added value. Choosing the right co-branded card requires a thoughtful look at your spending habits, income, and preferences. Make sure to evaluate key factors like annual fees, reward structures, partner brand perks, and exclusive privileges that align with your daily life.

Whether you’re a travel junkie, a gadget lover, or a smart saver at the fuel pump, there’s a co-branded credit card tailored just for you. So why wait? Pick the one that suits your needs, and when you apply through GoPaisa, don’t forget to claim your extra rewards of up to ₹1,500. Smarter spending starts here.